Skriv under på dokumenter i Gmail, uten å forstyrre arbeidsflyten

Fyll ut og skriv under på dokumenter på mindre enn 30 sekunder – uten å forlate Gmail. Vår brukervennlige og forhåndsutviklede Chrome-nettleserutvidelse lar deg skrive under på vedlegg med e-underskrift direkte fra Gmail-innboksen. Aldri mer skrive ut, skrive under og skanne!

Installer tilleggsprogrammet i dag

Du trenger ikke lenger laste ned dokumenter du skal skrive under på, for så å laste dem opp igjen til en annen side. Dropbox Sign for Gmail er laget slik at arbeidsflyten forblir i innboksen din – raskt og effektivt.

Du trenger ikke lenger laste ned dokumenter du skal skrive under på, for så å laste dem opp igjen til en annen side. Dropbox Sign for Gmail er laget slik at arbeidsflyten forblir i innboksen din – raskt og effektivt.

Det tar mindre enn 30 sekunder å skrive under en kontrakt med tilleggsprogrammet vårt. Slik at du kan komme gjennom innboksen raskere og sluttføre avtaler raskere enn noen gang.

Det tar mindre enn 30 sekunder å skrive under en kontrakt med tilleggsprogrammet vårt. Slik at du kan komme gjennom innboksen raskere og sluttføre avtaler raskere enn noen gang.

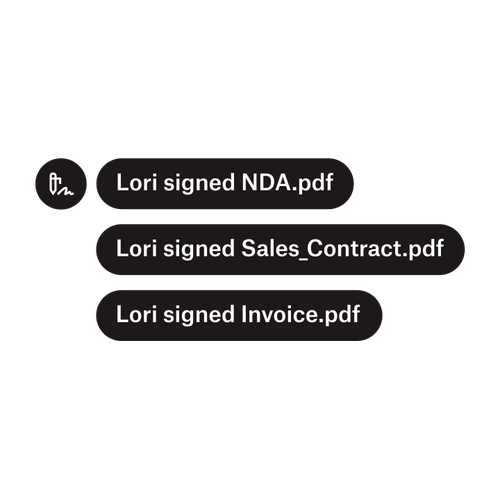

Alle underskrevne dokumenter inkluderer juridisk bindende elektroniske underskrifter i Gmail. De blir også automatisk sikkerhetskopiert til kontoen din, slik at du får ro i sjelen og for tilsynsloggen.

Alle underskrevne dokumenter inkluderer juridisk bindende elektroniske underskrifter i Gmail. De blir også automatisk sikkerhetskopiert til kontoen din, slik at du får ro i sjelen og for tilsynsloggen.

Slik skriver du under på et dokument i Gmail uten å forlate innboksen

Installer Dropbox Sign-tilleggsprogrammet for Gmail raskt

Besøk Google Workspace Marketplace for å installere Dropbox Sign-tilleggsprogrammet for Gmail.

Når det er installert, og du er logget på tilleggsprogrammet med din Dropbox Sign-påloggings-ID, vil dokumentet du mottar som vedlegg i Gmail ha en "Skriv under"-knapp.

Løsninger som gir målbare resultater

Kan jeg installere tilleggsprogrammet Dropbox Sign for Gmail uten Chrome-utvidelsen?

Trenger du eller de som mottar forespørselen om underskrift en Gmail-konto for å bruke Dropbox Sign?

Skriv under på dokumenter direkte i Google Drive

Du kan raskt gjøre dokumenter klare for underskrifter i Google Drive med e-underskrift-integrasjonen.

Send dokumenter til flere underskrivere

Det å lage godkjenningsarbeidsflyter med flere underskrivere er enklere enn du tror. Du trenger bare det rette verktøyet.

Forenkle arbeidsflyter med vårt brukervennlige API for e-underskrift

Finn ut hvordan Dropbox Sign API enkelt integreres i programmet eller nettstedet ditt.